How to Quickly and Accurately Plan Your Retail Sales Goals

/Photo: www.chinaeconomicreview.com

By Nima Ghodratpour

Question: How much do we need to sell?

Sell, sell, sell; the mantra that’s heard in board rooms, back offices and shop floors the world over. The corollary question by most sales associates tasked with achieving those sales targets is, where do these sales goals come from? Devising sales forecasts can be one of the most difficult and contentious endeavours one can ever be tasked with. As a retail manager you know that sales are affected by many different variables such as, the attractiveness of your product, your staff’s sales skills, investment in marketing, the state of the economy, even the weather outside! To produce a remotely accurate figure it seems you would need to take into account all these factors and then some.

The good news is there exists a simple and quick way to realistically forecast sales without having to resort to guesswork.

Photo: www.modernwearing.com

GENERATING SALES IS ALWAYS ABOUT MAKING A PROFIT

Everything in a budget, from costs and assets requirements, comes from the expected revenue generated by a business. All that planning and hard work is designed to do one thing. Generate profit. Therefore, successful sales management is all about producing an accurate sales plan from the outset to create a profit. So how can we predict the level of sales needed to generate the profit that we envisioned for our retail business? The answer to that is to use a Cost-Volume-Profit or ‘CVP’ analysis. The beauty of CVP analysis is that it takes in to account the relationship between, more concrete figures such as fixed and variable costs and how they affect sales and profit. It does in minutes what people may spend days, weeks or even months trying to prepare.

Photo: http://thehighlow.com

WHAT DO WE NEED TO GET OUR SALES FIGURE?

Suppose you have run into some inheritance money and you want to invest that money in a clothing store in what appears to be an excellent location that has just been put on the market to lease.

You figure that an initial investment of $600,000 is needed to fit out the store, buy inventory, get equipment and cover other on-costs. Is opening this store worth your time and more importantly your money? The answer to that depends on whether enough sales will be generated to cover your fixed expenses and make you a profit, that’s where CVP analysis comes in.

In the clothing store you have fixed expenses, rent, utilities, telephone, salaries, and so forth. In addition you want a return on your initial $600,000 investment. Let’s assume the fixed costs for the first year of trading will be $250,000. In addition you would like to achieve a profit of $90,000 (which represents a 15% return on your initial investment of $600,000). This establishes that you would like to generate enough sales to cover your fixed expenses of $250,000 and a profit of $90,000, adding these two figures together we can forecast a sales figure to cover the $340,000 needed to make the business viable.

Now that we have established our fixed costs and desired profit, we can start to plan our variable costs, or in retail accounting vernacular our COGS. To calculate our sales figure, we need to establish how much Gross Margin we want or realistically can make on our sales. On this basis, if our clothing store buys shirts for $60 and sells it for $100, the Gross Profit will be $40. This is $40 towards achieving your fixed cost and profit figure of $340,000. We can now say that the contribution towards our fixed cost and profit from each shirt sold is 40%.

LET’S GET THE SALES FIGURE!

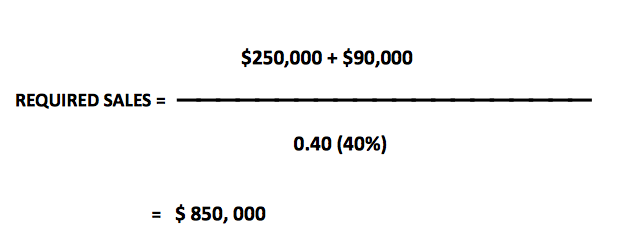

We have all the numbers we need to figure out what our sales figure would be, all that’s left is filling in the formula.

From our shirt clothing store example:

If our shirt retail store sells shirts at a margin of 40%, you will need sales of $850,000 in order to pay for your fixed costs of $250,000 and leave you with a profit of $90,000. The CVP analysis requires only three figures to come up with a sales number needed to achieve our profit target: planned fixed costs, planned profit and planned gross margin.

Photo: www.theepochtimes.com

IS OUR SALES FIGURE ACHIEVEABLE?

The beauty of CVP analysis is that it makes sales planning far more straightforward and cuts the guess work. In the case of our shirt store, based on our previous assumptions the question is, can we generate $850,000 of sales? If the answer is yes, then our profit target of $90,000 is achievable, our investment is viable. If the answer is no, it’s back to the drawing board. The proposed numbers do not work, one or all three of the figures need to be tweaked, either the planned fixed costs, planned profit or the gross margin.

Note how CVP has simplified the decision making process for the retail investor. It negates the need for guestimating what the sales are going to be in the future, you just make a decision on whether sales will meet or exceed a given number. Many issues companies face when failing to make a profit can be avoided if the company takes time to assess the viability of its sales forecasts from the outset. Using CVP analysis can provide you with a powerful tool to quickly and accurately to make a decision on the viability of a business.

Nima Ghodratpour is an MBA candidate at Queen's University with over 11 years of Canadian and International Luxury retail experience, working for Clinique, Bloomingdale's and Boutique 1. Nima can be contacted at linkedin.com/in/nimaghodratpour.

![Retail-insider-NRIG-banner-300-x-300-V01-3[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476525034-QRWBY8JUPUYFUKJD2X9Z/Retail-insider-NRIG-banner-300-x-300-V01-3%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-2[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476491497-W6OZKVGCJATXESC9EZ0O/Retail-insider-NRIG-banner-300-x-300-V01-2%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-4[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476508900-TJG5SNQ294YNOCK6X8OW/Retail-insider-NRIG-banner-300-x-300-V01-4%5B2%5D.jpg)