Study Reveals Canadian Consumer Habits and Retail Landscape

/Photo: Shutterstock

RedFlagDeals.com has released survey results from June of 2016, where it surveyed over 1,000 consumers on their shopping preferences. The good news is that because of the low Canadian dollar and costs related to international e-commerce, many consumers plan on shopping in Canada over the US. The bad news for some Canadian retailers is that in the survey, respondents overwhelmingly expressed the desire to shop at discount outlets over full-priced stores and independent retailers. For reference, RedFlagDeals.com has over 775,000 registered users and sees over four million monthly visitors to its site.

First, the good news. Over 85% of participants responded "yes" to the question: "With the current state of the Canadian dollar, are you planning to focus more of your spending locally instead of going across the border?" The remainder said that they'd continue shopping cross-border, primarily for goods not available in this country:

For those who shop online at U.S. retailers, the respondents said that their biggest deterrent was shipping charges (33.96%), followed by exchange rates (31.9%), duty fees (29.94%) and customs delays (4.2%).

Now for some potentially bad news for many Canadian retailers. Over 73% of respondents said that they prefer shopping at discount outlets, while 15.65% said that they prefer luxury retailers for the quality. The RedFlagDeals.com study also revealed that 10.87% of respondents shop at local independent retailers for unique products, as well as to support local merchants:

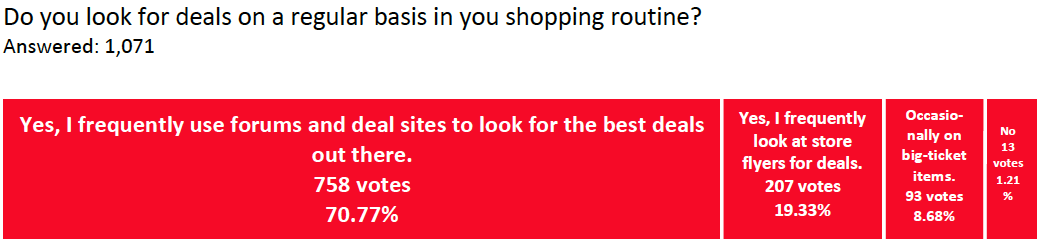

Almost 71% of respondents said that they frequently use forums and deal sites to look for the best deals, and only 1.21% said that they don't seek out deals. These numbers are likely skewed, however, given that RedFlagDeals.com solicited respondents from its site, which publishes thousands of deals over 70 categories:

The study also asked respondents where they do the majority of their in-store shopping, with 53.12% of respondents saying that they shop in large chain stores. Of the same set of respondents, 34.48% shop primarily at discount outlets, 6.43% at high-end retailers, and only 5.96% said that they shop at local, independent retailers.

The study examined online versus in-store shopping, with just over half of respondents saying that they shop both in-store and online, while 32.62% prefer shopping online only, and only 16.87% of respondents saying they shop exclusively in-store. This should be particularly concerning to retailers lacking e-commerce sites, which are more likely to be smaller independent retailers. The City of Toronto is hoping to get more local retailers online, for example, with its Digital Main Street initiative.

The survey listed several stores set to open in Canada within the next couple of years. Almost 42% of respondents said they'd shop at none of these, which isn't' surprising considering that the top three retailers are confirmed to only be opening in Toronto at this time. Nordstrom Rack (opening its first Canadian location at 1 Bloor Street East in early 2018) got 28.91% of votes, while Uniqlo (opening this fall at CF Toronto Eaton Centre and Yorkdale Shopping Centre) got 27.02% and Saks Fifth Avenue (which opened two Toronto stores in February of this year) got 16.29% of votes. Almost 9% of respondents said they'd travel to shop at these stores, which is great for Toronto's tourism numbers.

Referring to the new retailers discussed above, 46.96% of respondents said that they wouldn't increase their spending with the new openings, while 22.17% said they'd shop more during the hype of these store openings, and over 20% saying that they prefer to shop online, generally.

The survey also asked respondents which retailers they'd like to see open in Canada, and which retailers they were most disappointed to see exit Canada in 2015. Regarding which stores respondents would most like to see open in Canada, 57.53% said they'd like to see Macy's open here while 24.4% want JC Penney, 9.92% would like Barneys New York, and 8.51% would like Neiman Marcus to enter the Canadian market. Of the retailers which recently exited Canada, 46.87% of respondents were most disappointed to see Target leave, while 40.06% mourn the loss of Future Shop, 9.24% for Mexx and 3.83% for Grand & Toy (which continues to maintain an online retail presence).

![Retail-insider-NRIG-banner-300-x-300-V01-3[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476525034-QRWBY8JUPUYFUKJD2X9Z/Retail-insider-NRIG-banner-300-x-300-V01-3%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-2[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476491497-W6OZKVGCJATXESC9EZ0O/Retail-insider-NRIG-banner-300-x-300-V01-2%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-4[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476508900-TJG5SNQ294YNOCK6X8OW/Retail-insider-NRIG-banner-300-x-300-V01-4%5B2%5D.jpg)