The State of Retail in 2018 - Turbulent, Transformative, but Surprisingly Healthy

/[Source: The New Yorker]

By Charles De Brabant, Executive Director of Bensadoun Retail Initiative at McGill University

Besides Trump dominance of the airwaves, few other topics got as much attention over the last 18 months than what is happening in the retail sector.

However, the common narrative throughout the year seems misguided. Having just come back from more than 30 years outside North America to become the Executive Director of the soon to be launched Bensadoun School of Retail Management at McGill University, I was immediately struck by an overwhelmingly consistent view on the state of retail. Traditional is on its deathbed, overall retail is in doldrums with only one winner – Amazon. To quote former dot.com executive Seth Godin, “the battle for shopping is over and Amazon has won”. Looking in more detail at what has and is actually happening tells a different story.

Retail is a healthy, growing sector of the economy: Global retail is growing at an average annual rate of 6% over the last five years. Even in North America, retail sales figures indicate a sector of the economy that is healthy and performing well. Over the same period, retail in both Canada and the US has seen average growth rates of over 4%. 2017 was exceptionally good with 4.4% growth in sales in the US and an estimated 7% + growth in Canada if one includes the automotive sector and about 4.2% if we exclude it. The Holiday season year-end period was particularly strong with 5.6% increase in the US and 4.4% in Canada.

Given the estimated 2017 GDP growth figures of 2.6% in the US (Source: Bureau of Economic Analysis) and 3% in Canada (Source: IMF), these are retail figures to be proud of, not those of doom and gloom.

Retail is in a transformative period moving to two extremes: We do, nevertheless, see retail in a transformative period moving to two extremes: 1) convenience & efficiency and 2) experience.

The extreme of Convenience and Efficiency has to do with functional, day-to-day goods which are increasingly, but not exclusively being purchased online — think Amazon. It is allowing consumers to find the right product at the right price and at the right place in the most convenient and efficient way. It is a battle ground where technology plays a critical role through AI, big data, voice, hyper personalization, new payment platforms, … It is also an area where supply chain and retail operations optimization play a significant role in satisfying consumers, both in terms of speed and convenience. It is the ultimate battle ground between Amazon and Walmart. But not just them, we see Costco and the Dollar stores concept (eg. Dollar General, Dollarama, …) performing extremely well with principally a brick and mortar approach.

At the same time, we are seeing a rise in Experience based retail. This is more associated with our deep needs as human beings for social interaction. It is community-driven, more about doing, experiencing and storytelling. This is not new. Hotel groups such as Four Seasons, Food & Beverage concepts such as Starbucks and McDonalds continue to excel in this area, as do other concepts such as IKEA and Indigo. Experience based retail is also often closer to home or places that we love with locally sourced products in markets, handicraft driven concepts. It is usually more associated with physical shops, but not always. Take for example the online retailerSsense. Its highly curated content and product offering connect completely with its target community – worldly millennials who are fashion forward always looking for the newest and coolest products and experiences.

Retail is turbulent with some big losers: News headlines have focused on the demise of certain retail actors, namely Department Stores like Sears, JC Penney, Macy’s, others like Toys-R-Us. Department stores have seen a sales decrease in 2017 of close to 2% (Sources: NRF and US Census Bureau).

Take for example Toys-R-Us which recently announced the closure of 180 stores. On the convenience and efficiency end, it is losing out to the likes of Walmart, Amazon, Costco and even the Dollar stores, especially for all party related items, by not being strong enough in offering the right range of products at the right price in the right place. On the other end, its experience journey is leaving customers underwhelmed when compared to other retail concepts & activities that parents and kids love – eg. McDonalds, Ikea, Indigo, even Canadian Tire. Toys-R-Us is a cautionary tale. Choosing the middle of the road strategy is no longer viable, leaving them in a race against time to survive.

Traditional Food retailers are also under pressure with only marginal growth overall in Canada and razor thin margins. Attacked by Amazon, Walmart, Dollar Stores for day to day, repetitive purchases such as tea, coffee, toilet paper, detergent, .... They are also under threat from new business models such as meal kits such Blue Apron, Good Food, … and farm to table concepts.

As a result, most mall owners are seeing a decrease in footfall & sales. They are scrambling to stay alive by closing underperforming malls and trying to find new ways to do business and engage customers.

… but the emergence of winners

We are, however, seeing the emergence of winners at both extremes. Online retail had a banner year in 2017 with increase in sales of over 10% in the US (Sources: NRF and US Census Bureau) and up 35% in Canada (source: Stats Canada). Amazon was responsible for the lion’s share with about 44 percent of all U.S. e-commerce sales (Source: One Click Retail).

Walmart, for its part, has been aggressively transforming itself into an agile giant capable of operating as effectively off-line as on-line and working on not only bringing everyday low prices, but also trying to maximize convenience to their consumers. As a result, Walmart announced a 3% growth in US sales in 2017 which is impressive given its size and performance relative to other Brick & Mortar competitors.

Dollar Stores have continued to perform extremely well, by focusing on affordable household consumer goods. Home improvement and home furnishings retailers like Home Depot, Lowe’s have also finished strong with 7-8% growth (Source: Customer Growth Partners and US Census Bureau). Consumers want to do it themselves, at least in their homes. TJX with its treasure hunting approach with discount prices continues to perform strongly with a 6% increase (Source: TJX).

Consumers are also shopping closer to home. Proximity retailers have seen sales grow twice as fast the US market at 7.2% as of end of October 2017. Shoppers are skipping the malls in favor of neighborhood stores and are willing to pay higher prices for the experience and convenience. They are proud community members who are happy to engage with local retailers, buy locally sourced and manufactured products and are keen to keep their local environment thriving.

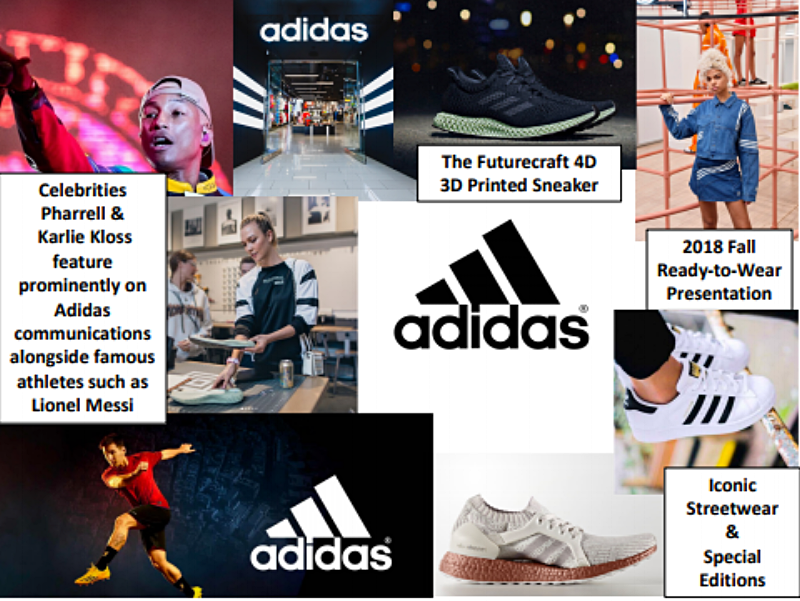

There are a number of other successful experience based retailers such as Indigo in the bookstore space, Gucci, Simons, SSENSE, Zara in fashion, Apple in the electronics space. A great example is Adidas which announced sales in 2017 increasing by over 15% and profits by over 25%. They have a very keen sense of their brand and the community of enthusiasts that they are engaging. They know what products, services, brand ambassadors and key opinion leaders that their loyal customers crave. They are masters at storytelling and bringing experiences to life that their fans love. And they use technology, trends, new ways of doing things as enhancers to their brand and what they are delivering to their customers.

The future of retail is both exciting and challenging for the CEOs and C-Suites

It is exciting times for the CEOs and C-Suite members in retail companies, but I do not envy the challenge of optimizing strategic and investment decisions. It seems that the choices are endless, but with finite resources. Do we invest in technology? If so which ones and for what

purpose? Do we upscale our operations (IT, Supply Chain, …)? Do we create a data analytics department focused on hyper personalization? How much of our business do we shift online? If so, which stores should we close? Do we invest in store customer experience and how? … So many options of where to strategically invest. Senior leaders will need to be agile, data savvy, but also intuitive and open minded. They will need to fully grasp their brand and the community that they are serving to make the best choices to enhance the effectiveness of their businesses. One thing is for sure, they will need to test, keep what works and discard asap what does not. This atmosphere creates a great mix of exciting times and sleepless nights!!

Charles De Brabant joined McGill University in August 2017 to co-lead the creation of the Bensadoun School of Retail Management (BSRM). He has over 20 years experience in retail in Europe and most recently in China and South East Asia. Born and raised in Montreal, Charles holds a B. Com. from McGill, an M. Litt. in History from Oxford University and an MBA from Stanford Business School. Charles’ focus at BSRM will be on collaboration with local and international industry partners and the administration of the school.

![Retail-insider-NRIG-banner-300-x-300-V01-3[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476525034-QRWBY8JUPUYFUKJD2X9Z/Retail-insider-NRIG-banner-300-x-300-V01-3%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-2[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476491497-W6OZKVGCJATXESC9EZ0O/Retail-insider-NRIG-banner-300-x-300-V01-2%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-4[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476508900-TJG5SNQ294YNOCK6X8OW/Retail-insider-NRIG-banner-300-x-300-V01-4%5B2%5D.jpg)