The Outlook for Athletic Apparel, by Chip Wilson

/Photo: Capital Group

By Chip Wilson

In the 1990’s, athletic competitors were Nike, Adidas, Puma and Reebok and the focus was all on shoes. Reebok owned the women’s “step up” market and could have become the dominant player, but they bet the farm on the competitive men’s sponsorship model and failed. They were then bought by Adidas, which had world dominance in soccer (especially as their younger German brother, Puma, fell behind). Adidas used Reebok as a vehicle to win the American non-soccer market.

Understanding logos is an important part of understanding the differentiation in the athletic market by sex, age and income. When I was young, I wanted t-shirts with big logos. I wanted other people to understand who I was, and because I was inarticulate and insecure, the logos presented my image and talked for me. I hoped my logo marketing would have the girls think I was cool. As I grew older and became more confident, I no longer needed the large logos. At the same time, I stopped growing and I could afford better quality clothing that lasted longer. I didn’t want disposable t-shirts and I wanted discreet logos. I wanted my clothing to match the quality of person I thought myself to be.

Photo: Global Stocks

Vintage Nike Shirt. Photo: Etsy

This insight influenced how I developed my companies. In my initial three businesses of surf, skate and snowboarding, the target market was 14-18-year-old boys. Logos were large and necessary. In the 90’s much of Nike’s and GAP profit came from large logoed t-shirts. In 1997 this trend came to an end leaving many Nike retailers with unsellable inventory.

Until 2006, athletic companies focused on low margin shoes. They were not apparel people and clothing was just an afterthought. They did not understand that athletic clothing provided higher margin and larger sales than shoes. The first forays into apparel from Nike, Adidas and Puma were for the most part non-functional and non-technical. Later on, Under Armour exploded onto the scene by exploiting a market gap in men’s football technical tops (“first-layer” shirts worn underneath uniforms) and building an entire business around it. Under Armour peaked when it raised money to fund its sponsorship wholesale model. Like Nike, they used the sponsorship model of paying athletes to endorse its products. Because Under Armour used a large logo format for branding, the product appealed primarily to teenage boys and insecure older men who wanted to look “in the know”. It hasn’t mattered that Under Armour sponsorships seemed “bought” as the wearers of Under Armour product were not sophisticated enough to care.

Nike applied the same model in its apparel, but used a smaller logo and placed it on the left breast - in the same spot as knockoff corporate golf shirts. Because Nike was more discreet, it sold product to a more sophisticated buyer than Under Armour. Nike’s big sponsorships “appeared” to be more authentic as their partnered athletes wanted to use the product.

Photo: Golf News Net

I’ve always believed that savvy consumers see through the bought loyalty of sponsorships. Indeed, the more sophisticated the buyer is, the more likely they are to appreciate true garment technology rather than celebrity endorsements. At the end of the day, these consumers are after a product with better quality and a smaller logo. The athletic companies are fortunate because consumers give them permission to use their logos on clothing a person can wear anyplace, anytime.

Adidas lost ground in the early 2000’s as their purchase of Reebok did not pan out. Nike, meanwhile, continued a very long and successful push into the world’s number one sport (soccer), while also driving aggressive shoe innovation. For a while, it appeared as though Adidas had lost its mojo and Nike would dominate the shoe market. However, Adidas had the foresight to start a joint venture partnership in China, which resulted in thousands of Adidas-branded stores there well before any other competitors.

In 2014, Adidas successfully reintroduced retro shoes and quickly followed up with more innovation. Overall, Adidas had among the best athletic stock value increases in 2017. I’m interested if they can leverage their future with a new foundation.

Photo: The Best Fashion Blog

In the early 2000’s Adidas had very little creativity inside the company, so the company made a strategic move in 2005 into a “collaboration” with Y-3 and then Stella McCartney. Adidas basically contracted out what they were not good at and have continued down this lower margin path. Puma made a brief comeback in the mid 2000’s when it was bought by a Hollywood producer who strategically placed Puma product in movies. He bought low and sold high and Puma has floundered ever since.

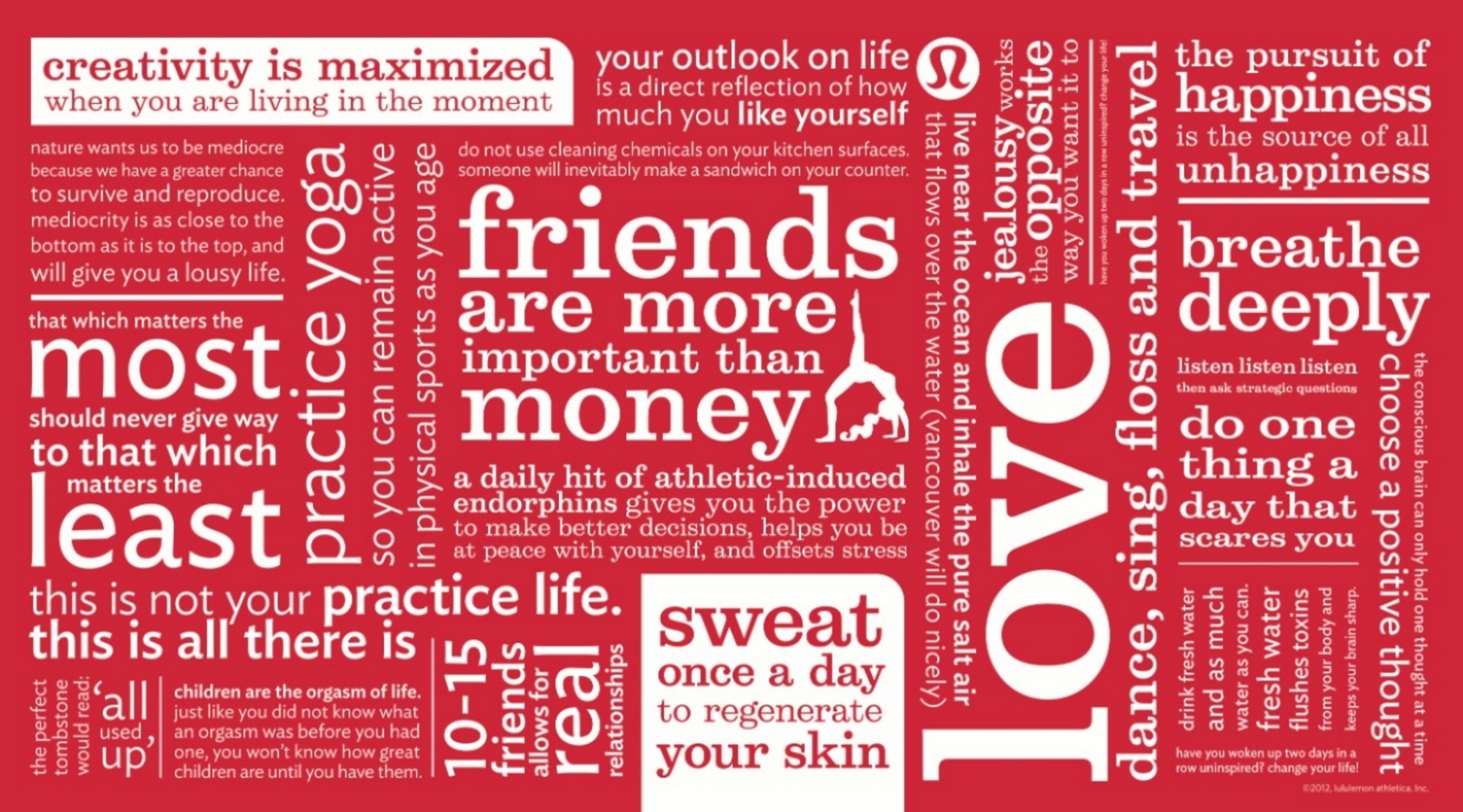

The biggest innovation and opportunity came with lululemon. In 1998, we invented the ‘streetnic’ (street technical) market and the technical vertical apparel business. Not only did lululemon have zero competition in the women’s athletic apparel market, but the women’s market was twice the size of the men’s business. As a bonus, the vertical model was far more profitable than the wholesale business as lululemon eliminated the wholesale middleman and did not use low profit shoes as an entry point to sell the apparel. Lululemon was started in 1998 and hit the ground running, since I already had 18 years of prior vertical retail experience that spanned from design to manufacturing to bricks and mortar.

Photo: Money Marks & Media (MMM)

There are numerous reasons why the wholesale model for athletic apparel is flawed. The established wholesale companies are forced to inject minimal technology into their product because they share their profits with their retailers and cannot afford the extra costs. The athletic wholesale companies make samples to show buyers far in advance of store delivery and the process takes 18 months. Even worse, retailer buyers tell the athletic companies what they will buy so innovation and creativity is directed by third party merchants who buy based on last year’s sales metrics. The tail is wagging the dog. Wholesale buyers consistently weaken the brand power of a manufacturer because last year’s, best-selling commodity products have less risk and makes for easier planning. It also makes for a boring product with little innovation.

By contrast, lululemon was beholden to nobody with a mandate to make a better-quality product at a better price than a wholesaler. Because lululemon had no one to show samples to, the turnaround from design to store floor only takes 9 months - amazing for technical fabrics. Lululemon became a fast “design to store” operation. Wholesalers with less margin are forced to follow lululemon’s forward designs with a product of less quality. For example, the wholesalers use inexpensive Polyester and lululemon uses expensive Nylon. Polyester holds in stink and nylon does not.

Sports Authority at Montrose Crossing. Photo: Bethesda Magazine/Andrew Metcalf

Wholesale has another huge downside. Nike and Under Armour suffered tremendously in 2016 with the bankruptcy of Sports Authority. Not only did the wholesale companies not get paid, but they were stuck with massive amounts of inventory in production for future seasons, which they could not ship to a non-existent Sports Authority. Nike and Under Armour worked to unload this inventory at low margins through entire 2017. Wholesalers sales dropped, inventory increased, and available cash dried up. Under Armour’s bonds were classed as junk and Under Armour’s market cap dropped from 18 billion in 2016 to 5 billion in 2017.

Lululemon is in full control of its cash flow as it gets paid each day by its own stores and ecommerce. In 2012-2013, the lululemon board and CEO stopped reinvesting in the foundations of the company and were unable to take advantage of what was the biggest change in the way people dressed in the history of the world. Lululemon’s leadership operated for quarterly reporting and was blind to future exponential growth and it lost its leadership position in apparel. Lululemon let the analysts into its front yard then into the living room, then the kitchen and then into bed. Analysts knew everything about the company except what made the company great, and what made it money.

Photo: Sneaker Bar Detroit

In 2017, after getting the crap kicked out of it with the bankruptcy of Sports Authority, Nike has announced its first partnership with Amazon and has declared it will only have 40 quality wholesale retailers by the end of 2018. Going forward I think Nike has made the tough decision to change its business model for the future and it has great legs. Its stock is fairly valued, and I would invest as I believe it to be a better performer than market average.

On the surface, Nike’s new model does not rid it of wholesale pricing markups. Nike must align wholesale offline pricing with online pricing, as its online pricing cannot undercut its wholesale accounts. If it undercuts the wholesalers the partnership collapses. This leaves Nike open to a competitor who does not have to support wholesale pricing markups and can develop a better product at a better price than Nike.

However, I am sure Nike will produce a different styled and priced product for online to create a dual-brand pricing model. Nike has enough global presence to use its mega stores as marketing centres, while leveraging ecommerce channels to champion lower prices as part of a long-term plan to diminish competition and ultimately improve profits. An uniformed analyst will punish Nike for lowering margins as it morphs into a new business model.

Photo: MPS Magazine

Meanwhile, lululemon is introducing shoes made by another company into its mix. A brick-and-mortar shoe store usually has a large back room and a small front display area, whereas apparel is the opposite. I suspect lululemon is testing shoes and has prearranged a deal to buy the shoe company after testing. Lululemon is using its large brick-and-mortar presence to show shoes for ecommerce, but not stock them in the stores. The APL shoes which lululemon now carries do not have the technical advantage required to authentically enter the market. This is like Starbucks selling high volume, poor quality food without understanding that food quality is subconsciously correlated to coffee quality.

Photo: Retail In Asia

Lululemon has the possibility of reimagining its retail footprint as ecommerce showrooms for not just shoes but for apparel. It could show five times the number of styles and ship direct from a single Asian warehouse to the global customer and minimize duties and shipping costs to the final consumer.

Under Armour is developing e-commerce only stores in China as a way of circumventing the wholesale model as they go internationally. This will be a brilliant international strategy if it works. A pure ecommerce play will net higher margins than lululemon’s brick-and-mortar model, which has to account for retail overhead in the pricing of its goods. However, Under Armour will also have to support its global wholesale pricing in China, which minimizes the effectiveness of its ecommerce play.

I suspect that lululemon does not have the courage nor the vision to lower margin and reflect the natural shift to a lower-cost but more profitable ecommerce model. Why? Because uninformed analysts would panic over short-term lower margins and guide investors away from the stock. If the analysts are scared, then so is the lululemon board, even though their mandate is to drive long-term value.

No real ‘streetnic’ competitor to lululemon has emerged yet. But just like lululemon had appeared with a better business model than the wholesaler (because it eliminated the wholesale middleman and delivered a better-quality product at a better price), a pure online competitor can do as well. The problem is that pure online competitors seem unable to grow their brand or attain critical mass of shoppers to buy pure ecommerce without some bricks and mortar retail. Customers need to know the fit or quality before confidently shopping online – this is forcing pure ecommerce players to open retail showrooms as a branding expense.

Photo: Lululemon.com

Ecommerce play works phenomenally well for lululemon, because it has enough global presence for consumers to understand its quality and sizing proposition. In addition, stretch fabrics made with 12% lycra have a forgiving fit and generate far fewer returns – among the lowest in the world of apparel. Furthermore, because Vancouver has a significant Asian population, it already understands sizing for the crucial Asian market.

Athletic apparel doesn’t emerge out of a vacuum. The physical location of a company is critical in recruitment, retention, culture, etc. Under Armour is in an uninspiring city of Baltimore and has a high employee turnover – especially in creative departments. Adidas, in Germany, has the same challenges, because of its remote rural location. Nike is in Portland, which is a very cool city but not international, and its fashion plate is fundamentally conservative mid-America. The athletic arm of the Gap, Athleta, is based in San Francisco, but it is merchant-run and not design-led, and past sales metrics leads its buyer to select apparel for the low price, low quality, non-athletic poser market.

Lululemon has the optimal physical location – Vancouver is international in outlook and operates business on the same day as its Asian retail and manufacturing business. The city also has a large population of athletes and creatives, including expats from Europe and Asia who bring global experience and a distinct sense of style. Unfortunately for lululemon, the board tends to overlook these resources, instead preferring to hire fashion and wholesale executives from the very companies lululemon does not want to be.

Photo: Style By Fire

Lululemon and Adidas have a large competitive disadvantage to Nike and Under Armour as maternity leave is one year in Canada and Europe. Lululemon’s core employee is the same age as its core consumer, a 32-year-old female athlete. As 95% of lululemon’s designers are females, most of which take their one year maternity leave with each child, it is absolutely crucial for lululemon to hire 6 months ahead of the curve with a superbly strong pipeline. But the pipeline investment has been lapsing, as the expense does not work for maximizing short-term public financial reporting. The loss of intellectual capital and high turnover due to the lack of strategic planning around this issue has cost lululemon over 200 million dollars.

Embracing a global sensibility can give lululemon an edge as it continues its international push. This global mentality is second nature to European companies like Adidas, which have always thought beyond their borders. Nike has been around long enough to be global and, like lululemon, had its quality roots in Japan. Plus, Nike’s success in the soccer realm has only increased its international credibility. Under Armour, by contrast, has a firmly American identity—rooted in American football and American athletes. This appeal does not necessarily translate internationally.

By contrast, the lululemon model—centered not around sponsorship but around a real community of brand loyalists—works internationally and is more authentic, self-generating and longer-lasting. The community model will continue to win the long-term brand hearts of customers. Lululemon currently boasts strategy but little vision, which limits its potential. Specifically, there’s a great deal of talk of innovation for the analysts and press, but I see very little true progress.

Photo: Nike

When Nike comes out with real innovation like flyknit (the lightweight, high-strength shoe fabric), the world knows about it. This elevates the Nike brand, and their entire product line can demand a higher margin. Lululemon, by contrast, has focused too heavily on short-term fashion, rather than long-term technology, to stimulate sales.

From 2013-2015, being unable to trade in lululemon stock without upsetting the market, I invested in Nike and Under Armour, precisely as they were ramping up for a massive growth curve. I did very well with these stocks, but not well enough to offset losses from my sizable, 30% position in lululemon, as the company continued to lose market share and value. I did well to sell Nike and Under Armour before the Sports Authority bankruptcy - not because I was smart, but because I believed ecommerce would take its toll on wholesale retailers caught in a commodity game.

I think Adidas has a good foundation and now can leap forward. With Nike leaving its wholesale accounts, Adidas could do very well filling the gap. However, the Sports Authority bankruptcy lesson will hang heavily on Adidas. Adidas massive presence in China will prove to be more profitable as the income level of the Chinese continue to rise.

Under Armour stock price has risen from the grave in 2018 and is rising in 2018 with all other retailers who have proven to analysts they can thrive in the new world of ecommerce. This is one company I believe doesn’t have a solid brand foundation, as its teen market and apprehensive adult market is finicky. Under Armour’s entry into low-end department stores like Kohl’s to replace its Sports Authority sales is a short-term fix for long-term brand pain. The stock is too risky for me.

Lululemon’s market value is marginally higher than it was five years ago in 2013. In comparison to the overall stock market gains and the massive growth in the industry, it lost its leadership position due to lack of reinvestment and is worth billions less than its potential. Nonetheless, it still has the best business model if a perfect combination of ecommerce and brick-and-mortar plays out.

PhoTO: Fayetteville Flyer

Photo: Odyssey

Lululemon’s biggest opportunity is taking advantage of high vacancy rates to renegotiate its leases at a 30% discount over the next three years. With these savings, lululemon can continue to make brick-and-mortar super profitable and drive brand like no other athletic company. Lululemon is five years late when it comes to expansion into global markets, and it is doing one billion less in its men’s business than it should. However, competitors are also not changing fast enough and lululemon has far more opportunity than it realizes. Lululemon will easily add another 20% to its value in 2018 despite its heavily weighted Private Equity ownership that is poised to sell down its position. Given my experience with Private Equity, I imagine short-term decisions might be occurring to boost short-term stock value to allow Private Equity to sell down.

Everyone, including me, is wondering how Amazon will affect the ‘streetnic’ market. I am careful not to be one of those people who said no one will want a home computer. Technical apparel is a different business than disposable streetwear. The technical apparel business is driven by people who design mountain gear where clothing must work for survival. To eat, live and breathe the technical business, a leader must be an athlete who envisions apparel as a bridge to solve all of life’s problems. This fanaticism drives quality, brand value and higher margin. I think Amazon and Alibaba will only win the non-commodity ‘streetnic’ market by buying brands where the owner is incentivized to continue being a technical problem solver.

In late 2017, I was asked to meet lululemon’s Creative Director who told me he was thinking of leaving lululemon because financial metrics were inhibiting design. I met him with two of his team members and he showed me his design vision for lululemon. At the end of the meeting, I told him his presentation was the same one I made for lululemon twenty years ago. It became apparent lululemon prioritized fashion designers and fired athletic designers. Lululemon is generally not innovating but only adding fashion to past innovations. This inevitably leads to a low-margin commodity fashion business. The board has strengthened lululemon’s back-end to provide for superb operational stability. But if the number one creative hire is twenty years too late to the party, something is wrong. Lululemon lacks leadership with the ability to interview and hire superior creative people to differentiate its westcoast branding position. When Private Equity controls an innovative product company, their route to increase value is usually to buy innovation. When buying innovation, they have to arrange for the founder to join the board or management. So, look for lululemon to start buying brands to increase value.

Under Armour made some terrible investments in digital technology in 2016. I am personally anti “built in digital apparel technology”. Digital garments feel uncomfortable and I observe people think health metrics are a great idea for forty-five days and then stop using them. People don’t want to think that hard.

Photo: ZDNet

When I was seven years old my dad told me that an electronic gadget would flex over my wrist and it would control my life. I overheard Steve Wozniak say the only thing he hated about the iPhone was the bulk in his pocket. The “life control wrist monitor” will run our lives. It will prick our skin monthly to access fluids. It will monitor all body functions and compare personal data to big data and provide a daily synopsis and probabilities of possible issues with solutions. It will also suggest health specialists to book virtual appointments.

I believe the future of apparel will be a single stretch, form-fitting Star Trek outfit (like Olympic athletes) which, due to 3D food printing technology, will fit everyone perfectly. I will own only one garment and I will wear it every day for 18 hours a day. Fabric technology will be embedded and the garment will not stink or stain. It will flex perfectly with the body and control heating as well as cooling with flexible vent holes or twisting fibres. I will choose the cosmetics of the outfit from one of the hundreds of design apps on my wrist phone screen and my stretch outfit will instantly change color or print.

That is the future for technical clothing, in my opinion —and today’s smartphone and technical apparel companies are poised to be at the forefront of this revolution.

Chip Wilson is best known as the founder of the yoga-inspired company lululemon athletica, and as a visionary in technical apparel. He founded his first retail apparel company, Westbeach Snowboard Ltd., in 1979. The venture sold apparel targeted at the emerging surf, skate, and snowboard markets. Wilson would go on to sell Westbeach in 1997 and founded lululemon athletica in 1998. In 2004, Ernst & Young named him Canadian Entrepreneur of the Year for Innovation and Marketing and in 2012 the University of Victoria presented him the “Distinguished Entrepreneur” award. Follow him on Twitter @ChipYVR and at his website at HoldItAll.

![Retail-insider-NRIG-banner-300-x-300-V01-3[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476525034-QRWBY8JUPUYFUKJD2X9Z/Retail-insider-NRIG-banner-300-x-300-V01-3%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-2[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476491497-W6OZKVGCJATXESC9EZ0O/Retail-insider-NRIG-banner-300-x-300-V01-2%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-4[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476508900-TJG5SNQ294YNOCK6X8OW/Retail-insider-NRIG-banner-300-x-300-V01-4%5B2%5D.jpg)