Mobile payment tech 'Mobeewave' Helps Pop-Up Merchants in Canada Increase Sales

/Photo: MENTRENDS

By Sarah Duquette , Zenergy Communications

Pop-up shops, which are often temporary, informal locations with limited or non-existent internet access and electrical plugs, do not operate in the same way as most conventional businesses as most of their sales are made over a short period of time. Pop-ups can be anything from retail to food vendors to beauty or fitness. Commonly, these businesses are only open for a certain number of days or weeks at a time, so every sale counts. Very often, their customers are visiting the area or have stumbled upon their business in passing. Finally, as we move towards a cashless society, sellers need to ensure that they can accept any form of payment to increase their chances to close on single opportunities to sell.

Having a mobile point of sale is important for these types of business operations but having reliable, secure payment infrastructure is essential. Due to their temporary nature, pop-up sellers are not interested in signing a long-term contract to rent or purchase a traditional payment terminal since they may only need it for a short time. Moreover, cost savings is a priority since many pop-ups are launched as a means for testing brick-and-mortar, and since sales are conducted during a short period of time, profit margins can be quite thin when reconciling profit over the whole year.

Photo: MENTRENDS

Photo: MENTRENDS

Temporary merchants such as pop-up vendors and entrepreneurs can avoid investing in expensive and complicated terminals and adding extra costs to their expenses by adopting mobile contactless payment technology.

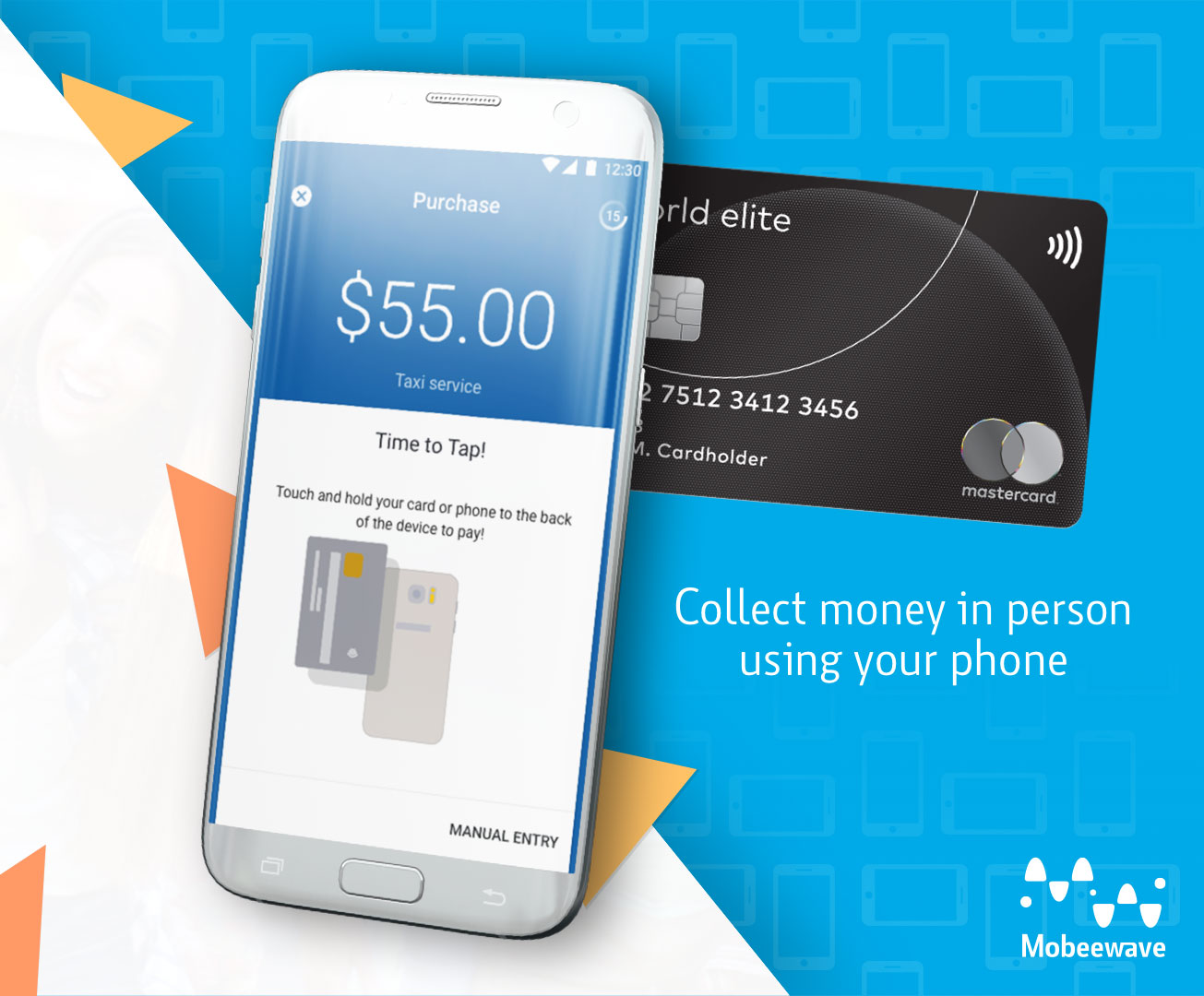

Montreal-based FinTech company Mobeewave has been a pioneering force in the mobile payment space since its inception in 2011, and has created a patented solution enabling anyone to accept money from a contactless card or a mobile wallet using only a smart mobile device, eliminating the need for external hardware or terminals.

This technology is revolutionizing the way small businesses operate as it allows merchants to collect payments with just a tap of their customer’s debit/credit card or mobile wallet against their smartphone and presents great opportunities for merchants to meet the growing expectations of consumers with regards to ease of payment in today’s new mobile age.

In an increasingly cashless world, Mobeewave’s simple and secure solution increases revenue and ensures that pop-up retailers and temporary merchants optimize their sales during their limited period of operations.

The Company says it is challenging every aspect of the current mobile payment paradigm.

“We’re digitizing the last sector where cash is still king: the world of cash-in-hand peer-to-peer and micro-merchant transactions,” says Vincent Alimi, Chief Growth Officer of Mobeewave. “Our patented and secure technology makes it possible for people to accept money with just a simple tap on their phones.” This resulted from intense research and development of innovative technology using NFC (near-field communications – a set of communications protocols that enable two electronic devices to establish communications between them) capability for use on mobile devices.

“While developing our patented solution, we knew that security was a major priority for in-person payments. That’s why our technology uses an extremely secure piece of hardware embedded on the phones called the secure element and as part of our due diligence, we tested the technology by establishing strategic pilots with partners such as Visa and Global Payments. Our solution has been proven in key initiatives such as with Princess Margaret Cancer Foundation’s fund-raising events, transactions for micro-merchants and our fact-finding mission for in-person money acceptance with PayMeTap.”

Alimi said the service is currently being used by more than 200 small businesses in Canada, 300 in Poland and 100 in Australia.

“We serve the underserved. Rather than target the end consumer, we target the micro-, small- and medium-sized merchants who can’t really afford to have electronic payment terminals because it’s too costly,” said Alimi.

In Canada, the company partners with National Bank and Global Payments. In Australia, it’s with the Commonweatlh Bank of Australia. And in Poland, with PeP, one of the leading payment processors.

“In the short term, we are going to continue our focus in a major way on Canada, Australia, the UK and Poland,” said Alimi.

In June 2018, Mobeewave announced its patented in-person contactless payment acceptance platform will be rolled out in the United Arab Emirates (UAE) – representing the Company’s first project in the Middle East and Africa (MEA) regions. It will enable merchants to accept payment from a contactless card or mobile wallet using just their phone – essentially turning their smartphone into a payment terminal.

The flexibility of the Mobeewave solution means that the platform is not limited by geographical restrictions. The fact that it can offer value to licensees in both mature and emerging contactless markets means that the platform could ultimately be deployed globally.

*Partner content. To work with Retail Insider, email: craig@retail-insider.com

![Retail-insider-NRIG-banner-300-x-300-V01-3[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476525034-QRWBY8JUPUYFUKJD2X9Z/Retail-insider-NRIG-banner-300-x-300-V01-3%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-2[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476491497-W6OZKVGCJATXESC9EZ0O/Retail-insider-NRIG-banner-300-x-300-V01-2%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-4[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476508900-TJG5SNQ294YNOCK6X8OW/Retail-insider-NRIG-banner-300-x-300-V01-4%5B2%5D.jpg)