Luxury Apparel Market in Canada to See Continuous Gains into 2023: Report

/photo: holt renfrew

By Mario Toneguzzi

A new report estimates that the Canadian luxury apparel market over the next five years will increase by 5.8 per cent in 2019 and by 18 per cent from 2019 to 2023 to $3.2 billion.

“Over the period 2019-2023 the Canadian luxury apparel market will increase at an average annual rate of 3.6 per cent, while the overall yearly growth rate for the Canadian total apparel market during the same period will average between 1.6 per cent and 1.9 per cent,” said the 2019 Canadian Luxury Apparel Market report by Trendex North America, a marketing research and consulting firm.

“The growth of the Canadian luxury apparel market will be driven in 2019 by a 7.8 per cent increase in luxury women’s apparel sales while men’s luxury apparel will increase by 5.2 per cent. As purse suppliers will be introducing fewer styles in 2019, the growth in the luxury purse market should increase by a maximum of 4.8 per cent in 2019.”

photo: retail insider (bottega veneta, yorkdale)

photo: retail insider (bottega veneta, yorkdale)

photo: retail insider (bottega veneta, yorkdale)

The report said the competitive intensity in the Canadian luxury apparel retail market over the next five years will continue to increase and will be driven by a number of developments including:

● An increase in the number of luxury apparel retailer doors, both in A malls and on “High Streets”;

● An increase in luxury apparel brands flagship stores on High Streets and in A malls;

● An expansion of the traditional boundary for High Street areas in both Toronto and Montreal

● Increased presence of luxury apparel retailers in Canada’s better off-price malls (e.g. Toronto Premium Outlets)

● Additional luxury mono apparel brand specialty retailers entering Canada for the first time;

● Growth of luxury apparel e-commerce sales. To what degree will the increase expand luxury apparel sales or simply replace traditional luxury apparel sales in brick and mortar stores cannot be determined; and

● Luxury apparel mono brand apparel/accessories retailers upgrading/expanding the size of their existing Canadian stores.

photo: michael muraz (valentino, toronto)

photo: michael muraz (valentino, toronto)

photo: michael muraz (valentino, toronto)

Randy Harris, president and owner of Trendex North America, said it’s important to note that the luxury apparel market grew by 6.5 per cent last year versus the 1.8 per cent growth for the total apparel market.

“The first reason for the market growing is the unprecedented boom in luxury apparel retail, meaning both the increase in the number of stores and the size of the stores,” he said. “That is partially due to the fact that Canadian malls have been reconfigured to host luxury apparel brands including their flagship stores and the expansion of the luxury zones, primarily in Toronto and Montreal.

“In addition to that we have a growth in ecommerce purchasing for luxury apparel which historically has not been a big factor but is becoming increasingly more so. We have an increase in foreign tourism too . . . Then lastly we have an increase in Millennial purchasing and those are the people that are buying a lot of aspirational luxury brands.”

photo: chanel (toronto)

photo: chanel (toronto)

photo: chanel (toronto)

The key is the accessibility. Quite simply, today there are more luxury retail stores in Canada which exposes many more Canadians to that segment of the retail market.

But Harris has a couple of concerns regarding the luxury market which include a potential decline in tourism which could really happen if the Chinese economy slows down significantly. There are signs that is happening although it’s a gradual decrease versus a big drop.

“The second concern I have is a decrease in Canada’s economy. The forecast for the next couple of years is lukewarm at best. I don’t think anybody believes that the economy is really going to take off. On the other hand, it could slip back depending on what eventually happens with the revised NAFTA agreement that has yet to be signed,” said Harris.

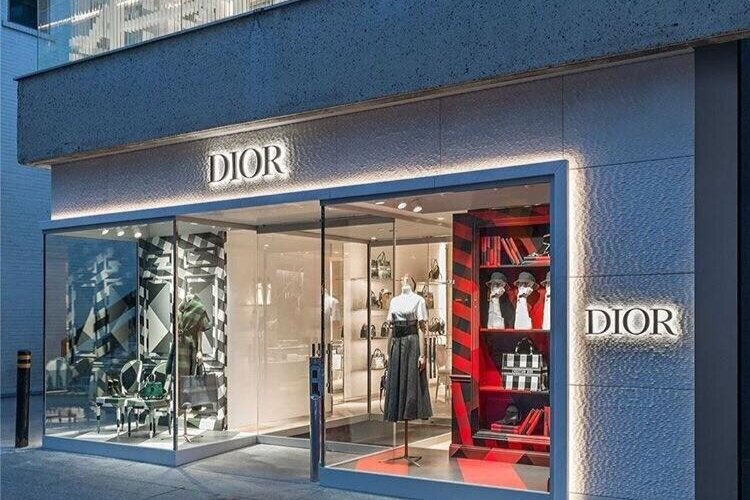

photo: kristen pelou (dior, toronto)

photo: kristen pelou (dior, toronto)

photo: kristen pelou (dior, toronto)

“The third thing I’m worried about is I believe we’re getting to the point that there’s going to have to be a shake out in the market as far as retailers grow because the amount of luxury buildings and outlets that are coming into play far exceeds the rate of which demand is increasing. So if you will, supply is probably growing at a rate that is 50 per cent greater than demand which means that the market is very vulnerable if all of a sudden there is any kind of a downward trend in the growth of the market.”

It’s also aggravated by the growth of luxury apparel retailers in the better outlet malls which never existed five years ago.

“At some point you’ve got to be almost Pollyannish not to think that the market is going to take a hit at some point. So at one hand we’re crowing about all the influx of new luxury retailers in the market for the first time. That’s good news. Always more choices are better for the consumer and you will note when these new people come in they only open one store,” said Harris.

photo: Evan Dion (hermes)

photo: evan dion (hermes)

photo: evan dion (hermes)

“But I’m worried about it long term if this keeps happening. Bottom line no curve goes up all the time. There’s got to be a downward move. I’m waving a red flag and saying that people need to be cautious.”

The report said the Canadian luxury retail apparel market over the next few years will become more competitive. There will be a slow but steady decrease in the number of Canadian-owned better independent apparel specialty retailers. Flagship store development will continue as the larger stores will be seen as providing a competitive advantage. Premium outlet malls will continue to gain share of the luxury apparel/accessories market.

photo: gucci (yorkdale)

photo: gucci (yorkdale)

photo: Gucci (yorkdale)

A number of secondary luxury apparel mono brand retailers will either leave Canada entirely, or will relocate from “high streets” to less expensive locations. Holt Renfrew will continue to invest in its stores in order to retain its position as Canada’s preeminent luxury apparel retailer. Simons will come to define a unique niche of luxury apparel retailing. Luxury apparel retailers will develop separate marketing programs targeted to affluent foreign tourists, Improvements in technology will allow for greater customization of the services that luxury apparel retailers provide their customers.

The report said luxury apparel retailers will increasingly compete on both the in-store experience they provide their customers along with their marketing campaigns targeted in some cases, to specific demographic niches (e.g. Asians, Millennials, etc.). The battle for luxury apparel market share will increasingly equally be fought in Canada’s A malls, on expanding “High Street” areas in Vancouver and Toronto and to a lesser degree in Calgary and Montreal.

Mario Toneguzzi, based in Calgary has 37 years of experience as a daily newspaper writer, columnist and editor. He worked for 35 years at the Calgary Herald covering sports, crime, politics, health, city and breaking news, and business. For 12 years as a business writer, his main beats were commercial and residential real estate, retail, small business and general economic news. He nows works on his own as a freelance writer and consultant in communications and media relations/training. Email: mdtoneguzzi@gmail.com

![L.L.Bean Continues Canadian Expansion with 1st Toronto Store [Photos]](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1603908990197-KDT3UNTEHFBFJF5FJ36N/L.L.Bean_Don_Mills_8.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-3[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476525034-QRWBY8JUPUYFUKJD2X9Z/Retail-insider-NRIG-banner-300-x-300-V01-3%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-2[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476491497-W6OZKVGCJATXESC9EZ0O/Retail-insider-NRIG-banner-300-x-300-V01-2%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-4[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476508900-TJG5SNQ294YNOCK6X8OW/Retail-insider-NRIG-banner-300-x-300-V01-4%5B2%5D.jpg)