Lightspeed POS Sees Explosive Revenue Growth in Fiscal 2020

/image: lightspeed

By Mario Toneguzzi

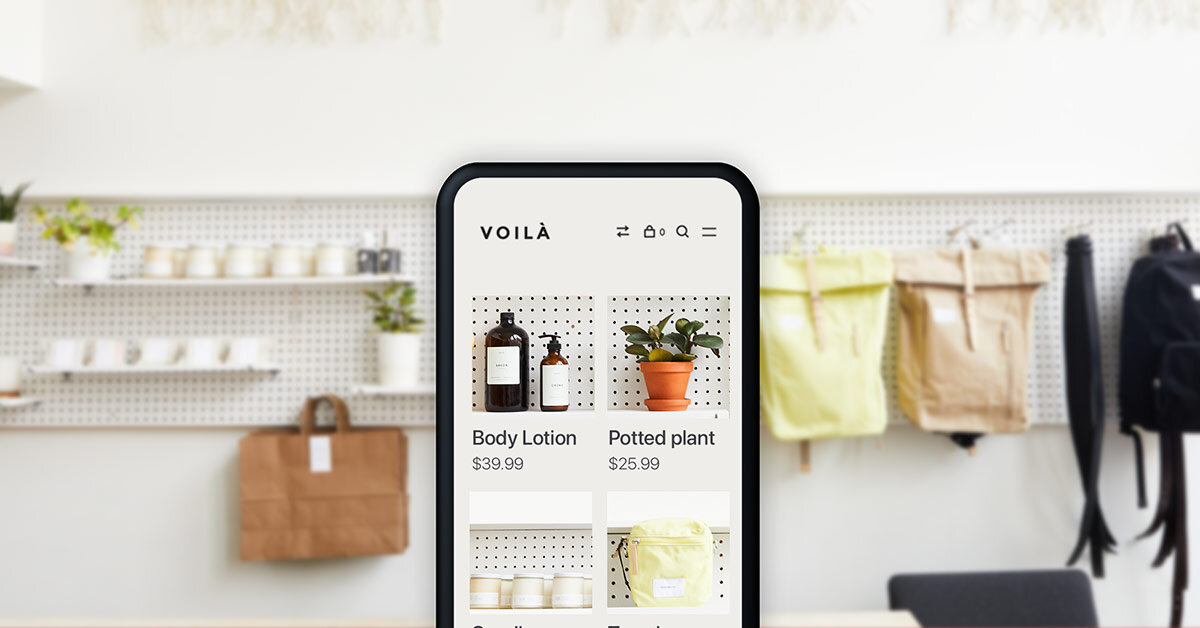

Montreal-based Lightspeed POS Inc., a leading provider of omni-channel point of sale platforms, experienced explosive revenue growth in both its fourth quarter and fiscal year 2020 which ended March 31.

The company recently reported that total revenue of $36.3 million in its fourth quarter was an increase of 70 percent compared to the similar period a year ago while total revenue for the year of $120.6 million was an increase of 56 percent.

"We are witnessing a historic shift in the way small and medium-sized businesses, the businesses at the heart of our communities, engage in commerce. Being omni-channel has never been more important," said Dax Dasilva, Lightspeed Founder and CEO. "Our merchants are progressive, omni-channel thought-leaders that continuously reinvent the retail and hospitality landscapes. We are proud to be their key technology partner and are committed to powering their growth."

"We delivered strong financial results to finish up our fiscal year, despite the difficult macro environment encountered through the back half of March," said Brandon Nussey, Lightspeed's CFO. "While the effects of COVID-19 will cause some uncertainty for the foreseeable future, we are encouraged by the signs we are seeing for Lightspeed's solutions and what it signals for our long-term potential. With over $210 million in unrestricted cash we are well positioned to invest smartly through this period and emerge as an even stronger global leader for our customers."

Lightspeed said it saw a record uptake in March of Lightspeed eCommerce, Lightspeed Delivery, and Lightspeed Payments platforms as retailers and hospitality businesses worldwide adopted new sales channels to continue reaching customers amidst the outbreak of COVID-19. The need for an omni-channel cloud solution coupled with modern, integrated payment solutions is no longer a competitive differentiator, but a business imperative, it said.

But in its fourth quarter Lightspeed experienced a net loss of $18.6 million compared to a net loss of $96.1 million a year ago and for its fiscal year it had a net loss of $53.5 million compared to a net loss of $183.5 million in 2019.

“The effects of the COVID-19 pandemic and related government shutdowns are impacting retailers and restaurants globally. We anticipate that customers' GTV (gross transaction value) and the demand for our services will be impacted and business failures in our customer base will increase so long as social distancing measures remain in place in the core markets we serve. However, Lightspeed's solutions have been helping to offset the toll that the pandemic is taking on hospitality and retail industries around the world,” the company said in a news release.

The company said the following trends have been apparent since the quarter end:

Despite present economic conditions, approximately three-quarters of Lightspeed's customers are actively trading, meaning that they are processing volume through Lightspeed's omni-channel cloud solutions;

eCommerce adoption remains robust with a 400 per cent increase in eCommerce volumes processed by Lightspeed retailers in April as compared to February levels;

Overall GTV from Lightspeed retailers in April grew approximately 50 percent from March levels;

Lightspeed Payments revenue had a record month in April, led by increased online sales, the impact of new customer adoption, and good performance across a subset of verticals such as home and garden, bike and pet;

Hospitality customer volumes remain challenged due to the ongoing government mandated shutdowns affecting most markets. Lightspeed's hospitality revenue base is mainly subscription software revenue that is not variable to underlying customer volumes, with the largest concentration in countries like Australia, Germany, Belgium, Switzerland, the UK, and France;

The number of hospitality customers now using home delivery and curbside pickup options has increased sharply. In Australia, for example, there has been five times the volume through these channels versus a year ago; and

New customer demand was encouraging through April with new retailers, golf courses, restaurants and mid market opportunities all choosing Lightspeed solutions. While churn and customers on reduced subscription plans remained elevated compared to historical norms, Lightspeed ended April with approximately 75,500 customer locations subscribed to Lightspeed solutions.

“Heightened uncertainty in the global economy is having an acute impact on everyone, including our customers, their consumers, our partners, our suppliers and our employees. The degree to which COVID-19 will affect our business, operating results and financial condition in upcoming quarters will depend on future developments that are highly uncertain and cannot currently be predicted,” said Lightspeed.

“In response to the present uncertainty, we have strategically re-directed discretionary spending and funding for certain go-to-market initiatives towards solution innovation. We believe we are witnessing an urgent and lasting paradigm shift in the needs of small and medium-sized retail and hospitality businesses and we believe strong fundamentals, including our broad omni-channel cloud solution set, geographically-diverse customer base balanced between retail and hospitality, subscription-based software business model, compelling payments offering, and strong balance sheet, position us well to capitalize on this shift.”

*Partner content. To work with Retail Insider, email: craig@retail-insider.com

Mario Toneguzzi, based in Calgary has 37 years of experience as a daily newspaper writer, columnist and editor. He worked for 35 years at the Calgary Herald covering sports, crime, politics, health, city and breaking news, and business. For 12 years as a business writer, his main beats were commercial and residential real estate, retail, small business and general economic news. He nows works on his own as a freelance writer and consultant in communications and media relations/training. Email: mdtoneguzzi@gmail.com

![Retail-insider-NRIG-banner-300-x-300-V01-3[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476525034-QRWBY8JUPUYFUKJD2X9Z/Retail-insider-NRIG-banner-300-x-300-V01-3%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-2[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476491497-W6OZKVGCJATXESC9EZ0O/Retail-insider-NRIG-banner-300-x-300-V01-2%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-4[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476508900-TJG5SNQ294YNOCK6X8OW/Retail-insider-NRIG-banner-300-x-300-V01-4%5B2%5D.jpg)

The iconic US-based retailer is looking to expand into new Canadian markets coast-to-coast.