Retailers Must Track E-Listening Habits to Stay Relevant

/woman streaming music on smartphone

By Arundati Dandapani

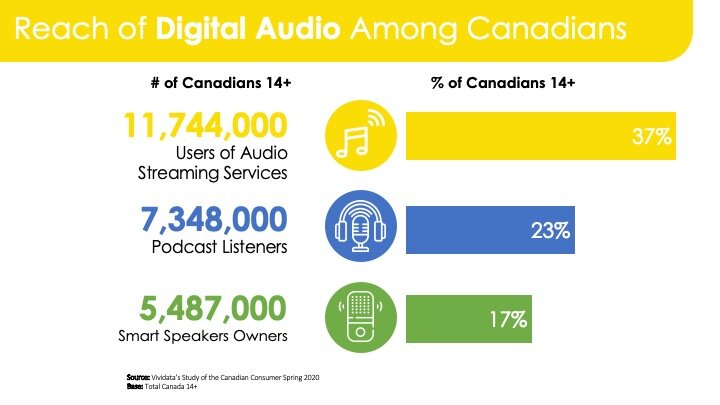

The pandemic has accelerated global media adoption rates of streaming across devices and platforms. Digital video consumption has soared followed by digital audio with Spotify being the most listened to platform in the US followed by Pandora. In Canada, according to Vividata’s Spring 2020 Survey, YouTube (54%) followed by Spotify (42%) are the top two streaming services and over three-quarters of Americans listen to music via streaming. Half of all Canadian respondents who owned a mobile phone streamed music, which is more than those who watched videos in the past month signalling new opportunities for retail brands.

What is E-listening?

E-listening includes streaming (listening) online or listening to downloaded music, radio, or TV. With the rise in digital streaming people have replaced their televisions and radios with the internet on computers or mobile devices.

In the US, 63% of respondents reported paying for at least one audio-streaming subscription, while 53% paid for two. Along with audio streaming, the rise in mobile streaming is worth tracking for retailers to understand streamers’ relationships with their devices. According to Vividata’s Spring 2020 Survey, currently four-in-ten Canadians stream audio content. Moreover, over a quarter (27%) of all Canadians indicated that being able to listen to the radio online has changed how they engage with audio content.

Over 40% of Canadian adults who stream audio for free or through subscription services (including podcasts) and over half of those who own voice-activated smart speakers and smart homes and smart devices shop most often online across categories, according to Vividata. E-listeners, however, continue to frequent physical stores and remain omnichannel shoppers! Retailers that understand the opportunity in meeting their customers on all touchpoints with reusable sonic assets will have an enduring reach with their consumers. Voice thus seems to contribute heavily in creating trust and intimacy with consumers. Developing an audio-strategy in such times is a no-brainer and retailers that espouse a sonic presence (whether it’s ambient music online or offline at their points of sale influencing visual search speeds for products or just creating the “affluence” mindset that inspires people to spend) or just those with a strong understanding of experiential marketing (offline) and user experience (online) are most likely to win against the competition.

Why are we E-listening?

Audio streaming answers the need for on-demand convenience and access, driven by its growing popularity among educated, affluent, employed and younger consumers. Further, the rise of audiobooks (eclipsing e-books in major markets like US and China), podcasting and voice-operated smart speakers points to the growing power of audio tech in consumers’ lives.

Globally brands saw a surge in e-listening during the pandemic. Spotify has a growing number of paid subscribers, rising to 130 million listeners (plus another 257 million free subscribers) of health and wellness tunes, meditative and instrumental music. In the UK and US, the top two activities performed online during the pandemic were searching for coronavirus updates followed by listening to music.

More retailers saw boomers shift their spending online through the pandemic in what is predicted to be an enduring change in shopping habits among this traditional cohort. A quarter of all Canadians stream audio content through podcasts, doubling in the past two years. Comedy, news and business remained the top podcast genres through COVID-19 for Canadians indicating an appetite for content conveying safety, comfort and motivation in uncertain times.

E-Listeners are Heavy Consumers of Home Electronics

E-listening is reported by users as helping them “unwind”, “slow down”, or “multi-task hands-free”. Students, followed by MOPES (Managers, Owners, Professionals, or Entrepreneurs), index highest in their use of audio streaming services with Generation Y, Generation Z and MilleXZials being the highest consumers of digital audio globally, according to Vividata and other sources. Smart speaker owners and podcast listeners are also the early adopters of this technology and report fluency with technology products, suggesting that all those who listen to digital audio are also “digital natives”.

Smart devices are electronic devices wirelessly connected to other devices. Smart speaker ownership skews young and affluent with those earning over $75,000 annually being 36% more likely to own such devices than the average Canadian. In the US, 81% of Americans own a smartphone (in Canada it’s 85%) with one in five US consumers being smartphone-only internet users. With 91% of US consumers reporting subscription to a video-streaming service and 30% subscribing to three or more such services, consumers’ e-listening habits are growing. Most voice commands today issued by smart speaker owners in Canada are for music streaming and weather updates (56% each) with a quarter of all voice commands used for listening to live-radio online.

E-listening is device-driven, and “e-listeners” (audio-streamers) are 13% more likely than the average Canadian to prioritize equipping their households with the latest technology and to be vocal about their opinions surrounding product and services online. This group is also 15% more likely than the rest to spend upwards of $2500 on home electronics or entertainment products in the past two years. This social affluence and comfort and awareness with technology spells opportunity for retailers looking to capitalize on product review platforms and build online communities that act as net promoters and drive traffic to storefronts.

Walmart and Canadian Tire appear to be the top sources of purchases for e-listeners who purchased consumer electronics including smart devices in the last two years, according to Vividata. Google Home (60%) followed by Amazon Echo (29%) are the top smart speakers owned by Canadians whose household ownership of voice activated speakers has more than doubled in the past year alone. In the US, the Amazon Echo boasts a roughly 70% market share compared to just 25% for Google Home and 5% for Apple HomePod even as smart device ownership peaks. It is true that consumers can hear faster than they see, taste, smell or feel, with each sound wave reaching the human brain in 0.05 seconds, triggering heightened emotion and stimuli. Tapping into the growing motivations and values of e-listeners will help retail brands program and orient for the next normal as it evolves.

Arundati Dandapani advises non-profits and businesses with data storytelling at the intersection of cannabis, media and marketing (or social) research. A well-published research professional, she is the Founder of Generation1.ca, an online cross-sectoral resource and outlet for Canada's newest residents. She has been honoured with notable industry awards, is involved with multiple industry associations, and is the Chief Editor of Canada’s MRIA-ARIM. She can be reached at arundati@generation1.ca.

![L.L.Bean Continues Canadian Expansion with 1st Toronto Store [Photos]](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1603908990197-KDT3UNTEHFBFJF5FJ36N/L.L.Bean_Don_Mills_8.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-3[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476525034-QRWBY8JUPUYFUKJD2X9Z/Retail-insider-NRIG-banner-300-x-300-V01-3%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-2[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476491497-W6OZKVGCJATXESC9EZ0O/Retail-insider-NRIG-banner-300-x-300-V01-2%5B2%5D.jpg)

![Retail-insider-NRIG-banner-300-x-300-V01-4[2].jpg](https://images.squarespace-cdn.com/content/v1/529fc0c0e4b088b079c3fb6d/1593476508900-TJG5SNQ294YNOCK6X8OW/Retail-insider-NRIG-banner-300-x-300-V01-4%5B2%5D.jpg)

Other news: Gap closing most mall stores, co-working space replaces Shinola store, Star Bédard rebrands, Nobis gets charitable.